You are Not A-Loan

DEBT, Debt, debt, DONE!

(as in Beethoven’s Fifth)

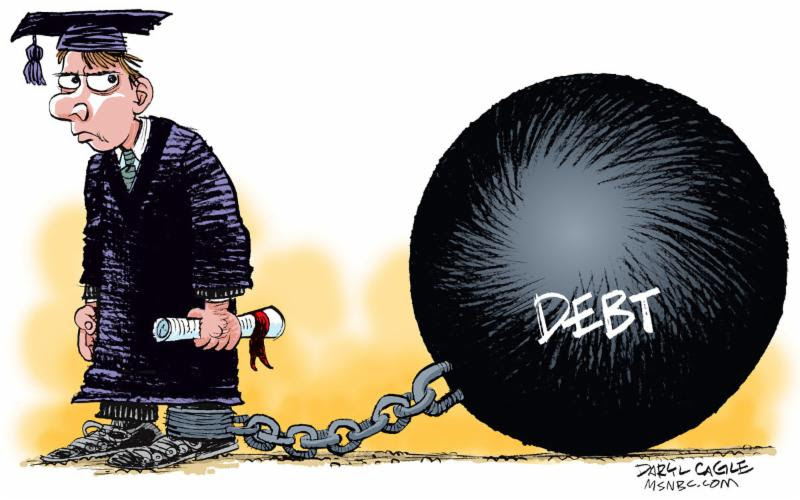

You know the story. Student loan debt, well over 1 trillion dollars, exceeds credit card debt and is crippling graduates — and in turn, the whole economy.

I had a pediatrician in my office who was making well over six figures, owes $300,000 on her student debt and yet Sarah cannot deduct a dime of her payments.

George is in sales, he owes far less — but is barely able to make the payments and stay out of default, which would subject his tax refunds and even his eventual social security benefits to “offset” (reduction).

Are there any viable options, Horace Mann?

There are a variety of “income-driven plans” that peg your student loan payment to your income, while extending the payback period to 20 or 25 years. Income-contingent repayment, income-based repayment and Pay As You Earn plans peg your monthly payments to a percentage of your net income — 20%, 15% or 10%, respectively.

Balances owed at the end of the period are forgiven!, but the cancelled debt would be taxable (at least under current tax law.) Each program has slightly different criteria and formulas, although none of them apply to privately-issued loans. The most generous — PAYE — is only available to recent grads.

While the idea of a two-decade plus repayment plan is intimidating, remember that you can always accelerate payments if things get better. Click here or here! to learn more. Your tax filing status might also come into play, and yes, I can help you “run the numbers.” E-mail me.

(The SLBA — Student Loan Borrower Assistance — has an excellent “step by step guide to solving your student loan problem.”)

Now, why was Sarah unable to deduct her student loan interest?

Once your income tops $65,000 (if you file singly), your ability to deduct student loan interest is “phased out.” Once you hit $80,000 it’s gone. You borrowed money to put you on a sustainable career path — and once you are on that path you can barely, if at all, take advantage of this (already minimal, capped at $2,500, even for joint filers) tax deduction. Don’t get me started on the inequities in the tax code that get little attention.

What else to consider? If you own a home and have sufficient equity you could borrow against it and take advantage of the mortgage interest deduction. However, if the interest rates are not comparative this may not be an attractive option.

This is an issue that is not going away, Elizabeth Warren. Watch for more policy proposals at the federal and state levels,

BECAUSE YOU ASKED

Are there any other mensches in your family?