Withholding 101

I have a prosperous and intelligent — let’s say attorney — as a client. “Shirley” was experiencing some cash flow issues last summer so I took a look at her year to date income and withholdings and projected what her tax return would look like come April.

The news was good —she had already met her federal tax obligations for the year. I advised her to increase her withholding allowances substantially through December ’14 and take some more money home — but to check back with me after New Year’s. After all, Shirley could only afford to lower her withholding amounts (through higher withholding allowances) for the last part of the year because she had withheld so much up until that time. She would need to reset.

Shirley was busy and disorganized all winter and never got around to resetting with me. Her tax return was extended and we didn’t catch up until a couple of weeks ago. Shirley’s 2014 return was fine — indeed, she had a small refund from her large withholdings for most of the year. I asked to look at her current paystub to see where things stood for 2015, and we were both horrified. She was still only withholding about $50 per paycheck, and at the current rate would owe at least $15,000in tax money she didn’t have, come next April. Shirley’s failure to reset would cost her big time.

We had to scramble. Shirley suspended her retirement contributions, cancelled some urgent household repairs to make a couple of estimated tax payments, and increased her withholding amounts dramatically. She barely avoided having to raid her retirement plan, which would have created yet another tax problem.

The moral of the story is simple: As my magnet says, “Bliss requires careful planning.” Every year I have several clients whose withholding went down substantially from the prior year, or took a new job and filled out the forms incorrectly. Check your pay stubs periodically —companies and payroll services make mistakes as well. Shirley confessed she was a bit surprised that her cash flow had improved so much, but had not thought to review her paystubs.

If you are interested in becoming a client and would like a free estimate of where your tax liability stands, e-mail me. And if you don’t have at least one of my magnets — why not?

DATES TO REMEMBER

October 15, 2015 Final tax deadline to file individual taxes for 2014. Want to know how the penalties for late filing accrue? Read here. If you can’t pay all at once, read about your options.

November 30, 2015 Rhode Island LLC’s must file their annual renewals with the Secretary of State. It costs $50 and takes a few minutes, and you can file online. Or, as I discussed last month, you can just forfeit your corporate status by not keeping your records up to date.

BECAUSE YOU ASKED

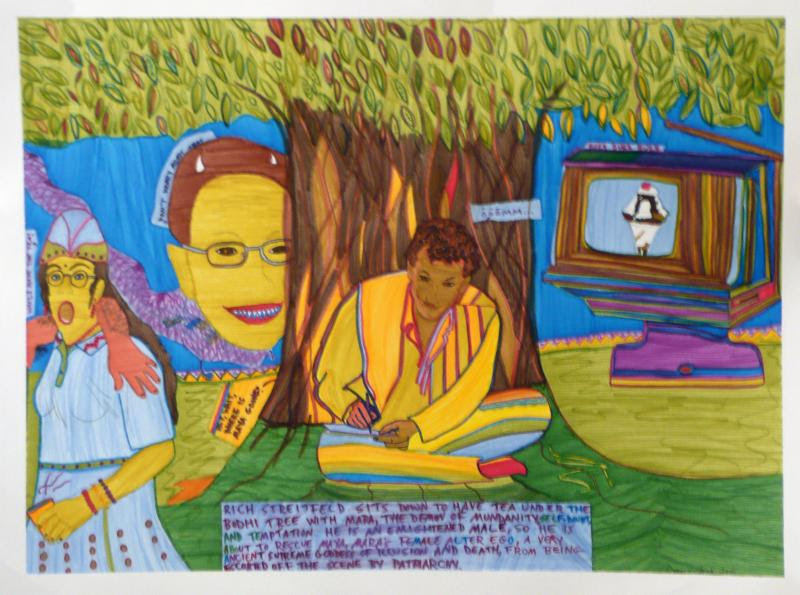

Some years ago my then wife Dorota and her friend Wayne were in a small art group; every month they would choose a theme to create something for the next meeting. For one month Wayne suggested “Rich Streitfeld.” Nobody else knew who I was, and all they had to go on was a picture of me. I attended the meeting where they each presented their artwork “about me”.

I nearly fainted when Deenie Pacik (a wonderful, Providence-based glass artist) started by saying she had decided to do something with a Buddhist theme — again, without knowing anything about my background. The picture you see. which hangs in my office, was the result. In the text I am described as an “enlightened male” who is “rescuing an ancient goddess…from being escorted off the scene by patriarchy.”

Because you asked. And by all means, keep asking.

* The Bodhi Tree — according to Buddhist tradition, The Buddha attained enlightenment sitting under a tree in Bodh Gaya, India.