Tax Briefs, Rich’s Pet Peeves

A Tale Of Two Sisters

Hello Rich,

Happy New Year! Tax season is upon us — okay, ME. Here are some brief suggestions, reminders and cautions. My aspiration for 2020 — not to give up, on my community, country, planet. Best wishes — Rich

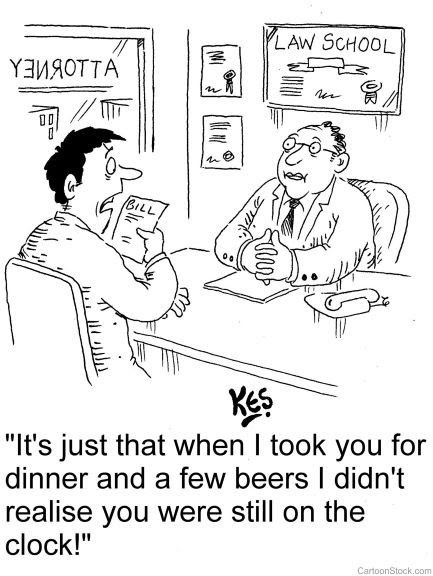

Not Every Meal Is Deductible!

Not every meal or beverage you take in during business hours is deductible. If you are not traveling, then every meal must have a business purpose AND shared — with a client, prospect, colleague (or your CPA!). When I see a $5.00 charge for Starbucks every day, I see red flags marching toward my client. (If you are traveling for business overnight you may dine alone and still deduct the meals.)

Not every meal or beverage you take in during business hours is deductible. If you are not traveling, then every meal must have a business purpose AND shared — with a client, prospect, colleague (or your CPA!). When I see a $5.00 charge for Starbucks every day, I see red flags marching toward my client. (If you are traveling for business overnight you may dine alone and still deduct the meals.)

Not All Donations Must Be In Cash

Your donations of goods — to Goodwill, the landing dock at Savers (beneficiary is Big Brothers/Big Sisters) are deductible, as long as you are able to itemize (see last issue.) This is tricky — you get a slip that gives you a one line summary of what you gave — but what of the value for tax purposes?

Check out this handy guide from the Salvation Army. Of course it cannot be specific to your situation but try to stay reasonable. If Rich deducts $2,500 for a new bedroom set every year or $500 annually for his snazzy art ties it may not pass the smell test. The value is what it would sell for at a thrift store, Charlotte — not what you bought it for! Lots of us shop these places so we already have a sense.

What I Never Hear On Campaign Trails

My quadrennial kvetch. College is exorbitant, whether paid through student loans or from savings. usually a combination. And we are told a college education is the best pathway to earning a decent living. Right?

So look at the meager tax incentives available for higher ed. If you are a single parent with student loans and make over $85,000??, no credit for you. If you are married and together earn over $160,000 — and working overtime to put James and Miranda through university — well, bye bye to any (often minimal), help through the ‘tuition and fees” deduction.

A Tale Of Two Sisters